This summary is for informational purposes only and may be subject to change. For a more detailed description of coverages, please see the TFPA Underwriting Manual and TFPA Rating Rules. You may also see sample policy forms and endorsements. In the event of any conflict between this summary and the terms of a policy, the terms of the policy take precedence.

Texas FAIR Plan Association provides limited coverage through the TFPA Homeowners Policy, TFPA Dwelling Policy, TFPA Condominium Policy, and TFPA Tenant Policy. The policies provide:

Dwelling Coverage (Homeowners and Dwelling Policies only) – Policies provide actual cash value coverage for your dwelling and outbuildings. Actual cash value is replacement cost minus depreciation.

The Homeowners Policy may be endorsed to provide replacement cost coverage. Replacement cost is what you would pay to rebuild or repair your dwelling, based on current construction costs. Replacement cost is different from market value. It does not include the value of your land.

To be eligible for replacement cost coverage you must insure your dwelling for 100 percent of its replacement cost value. If at the time of loss your home is insured for less than 80 percent of the full replacement cost, TFPA may only pay part of the loss.

Replacement Cost Coverage is not available on the Dwelling Policy.

Personal Property Coverage – Policies provide actual cash value coverage for household contents, such as clothing, furniture, appliances, etc. Actual cash value is replacement cost minus depreciation.

The Homeowners Policy automatically provides coverage at an amount equal to 50 percent of the dwelling amount of insurance. This means if you insure your dwelling for $100,000, its contents are insured for up to $50,000. Increased Personal Property Coverage of 60 percent or 70 percent of the dwelling amount of insurance is available at an additional premium charge.

The Dwelling Policy may provide coverage for contents at selected limits up to a maximum of 50 percent of the dwelling amount of insurance.

The Condominium Policy and Tenant Policy provide coverage for contents at selected limits up to a maximum of $500,000.

For an additional premium, the Homeowners, Condominium, and Tenant Policies may provide replacement cost coverage for your personal property (not available on the Dwelling Policy). Replacement cost coverage gives you more protection than actual cash value coverage. (Example: A burglar steals your six-year-old television set. With actual cash value coverage your claim payment would be based on the cost to replace the television set with a similar set minus depreciation and your deductible. With replacement cost coverage, the claim payment would be based on the cost to replace your TV with a new set similar to the one stolen, minus your deductible, once you have complied with all the policy conditions.)

Limitations of coverage apply to certain contents, including business personal property, jewelry, watches, furs, and money.

Loss of Use Coverage – Pays additional living expenses if your home is uninhabitable due to a loss caused by an insured peril while repairs are being made.

Liability Coverages – The Homeowners, Condominium, and Tenant policies also provide Personal Liability and Medical Payments coverage:

- Personal Liability – Protects you against financial loss if you are legally liable for someone else’s injury or property damage up to the limit of liability.

- Medical Payments – Pays medical expenses for persons other than residents of the household injured while on your premises and for some injuries that may happen away from your premises up to the limit of liability.

Coverage Limits – The following coverage limits are available, where applicable:

- Dwelling – Up to $1,000,000 maximum value

- Other Structures – 10 percent of Dwelling Coverage amount

- Personal Property – 50, 60, or 70 percent of Dwelling Coverage amount on the Homeowners Policy. Optional up to 50 percent of Dwelling Coverage on the Dwelling Policy. For Condominium and Tenant policies, limits are available up to a maximum of $500,000.

- Liability - $100,000 or $300,000 limit

- Medical Payments - $5,000 limit per person/$25,000 per occurrence

- Loss of Use – 10 percent of Dwelling Coverage amount, 20 percent of Personal Property Coverage amount on the Condominium and Tenant Policies.

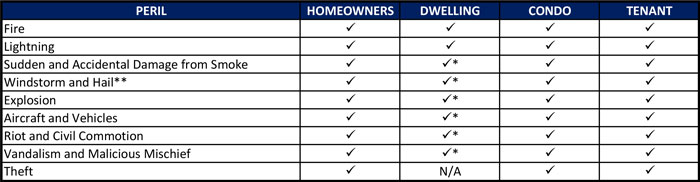

TFPA policies provide coverage for damage caused by:

*Dwelling Policies include coverage for the perils of fire and lightning; coverage for other perils in the above table (sudden and accidental damage from smoke; windstorm and hail**; explosion; aircraft and vehicles; riot and civil commotion; vandalism and malicious mischief) is optional and must be added as an extended coverage.

**By law, TFPA may not provide windstorm and hail coverage for property located in the designated catastrophe area consisting of 14 coastal counties and a portion of Harris County on Galveston Bay. A policy written by TFPA on such property must have a Windstorm and Hail Exclusion Agreement attached to the policy. Consumers in a designated catastrophe area may purchase windstorm, hurricane and hail insurance on insurable property through the Texas Windstorm Insurance Association.

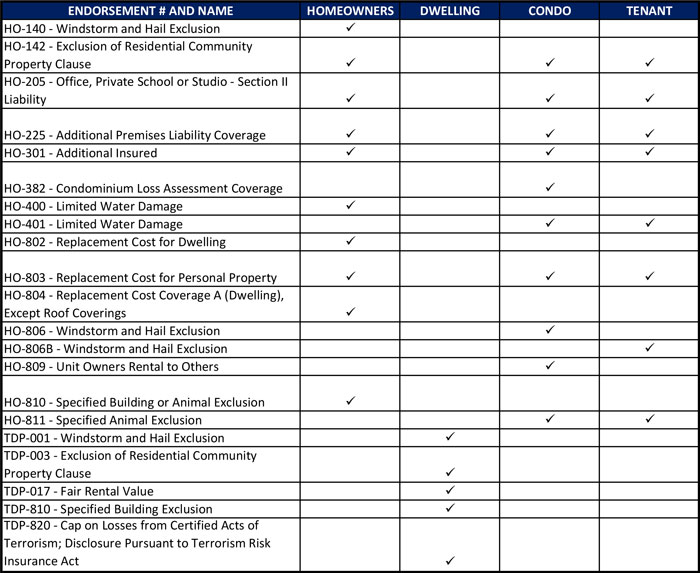

Available Endorsements:

Payment Options:

- Annual Payment, Policyholder billed

- Annual Payment, Mortgagee billed

- 2 Payment*** (60% down payment and 1 installment)

- 4 Payment*** (30% down payment and 3 installments)

- 10 Payment (Auto Draft)*** (15% down payment and 9 auto drafted installments)

***A $5.00 service charge is added to each installment payment

Payment FeesWith new policies effective October 2018, policyholders have the option to pay their insurance premium electronically. Please visit our e-payments page to learn more.